[ad_1]

Top 15 Fake Loan Apps In Nigeria 2022 | Avoid Number 8 By All Means

An investigation by QUICK LOAN ARENA has revealed the existence of many predatory and fake loan apps in Nigeria whose sole purpose is to scam poor and hapless customers who are unfortunate enough to request loan advances from them.

These fake loan apps according to QUICK LOAN ARENA are either demanding illegal security down payment from their potential customers or asking them to pay processing fees for loans. Some others are fond of threatening and blackmailing customers at every given opportunity, insulting and using derogatory language on them.

How To Identify Fake Loan Apps In Nigeria

Most of these fake loan apps in Nigeria have tenure ranging from 7- 14 days, this is in breach of Google Policy on loan apps hosted on its Play Store and contravenes local laws in Nigeria. Hear what Google has to say on loan tenure:

‘’We do not allow apps that promote personal loans which require repayment in full in 60 days or less from the date the loan is issued (we refer to these as “short-term personal loans.’’

Some others have turned their platforms into loan sharks terrorising Nigerians with extremely high-interest rates sometimes as high as 50% for 7 days tenure and then later harassing the consumers and their contacts with malicious and defamatory words even when it’s still a day to loan expiration. This is unethical.

Yet some others of these fake loan apps we have identified are contravening Google network laws in terms of data collected by them. This is what Google says about data collected by apps on its Play Store:

You must be transparent in how you handle user data (e.g. information collected from or about a user, including device information). That means disclosing your app’s access, collection, use and sharing of the data, and limiting the use of the data to the purposes disclosed. In addition, if your app handles personal and sensitive user data, please also refer to the additional requirements in the ‘personal and sensitive user data’ section below.

These Google Play requirements are in addition to any requirements prescribed by applicable privacy and data protection laws (in the country of your domicile).

Finally, most of these fake loan apps in Nigeria now charge illegal loan service fees while feigning to have low interest. This is unacceptable.

The National Information Technology Development Agency (NITDA) has also resolved to sanction and rein on these fake loan apps in Nigeria and their lending platforms operating in Nigeria over these unethical practices of blackmailing and threatening consumers, their family members and their contact lists who were never parties to the loan agreement, whenever there is an alleged repayment default.

Top 15 Fake Loan Apps In Nigeria 2022 | Avoid Number 8 By All Means

Many of these fake loan apps do not have any physical office address, do not have a website, some don’t even have any online presence yet they found their way somehow into Google Play Store and get into scamming poor Nigerians of their hard-earned money. Google should bring down and clamp down on more of these loan apps once they are discovered to be violating its set down policies.

The following form our list of top 15 fake loan apps in Nigeria. QUICK LOAN ARENA advises borrowers and customers to avoid them at all costs. Many have been scammed and defrauded, and their bank accounts illegally debited by these fraudulent digital lending apps.

1. NairaPlus Loan App

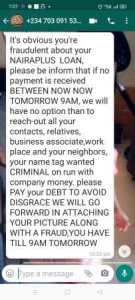

NairaPlus is the first on the list of fake loan apps in Nigeria. The scam lending platform is one of the quick loan apps on the Google Play Store that are invading the data privacy of their customers and sending blackmailing and threatening messages to their contacts whenever there is an alleged loan repayment default.

We understand this is in breach of their customers’ data privacy policy which the different loan apps vowed to adhere to during registration and hosting on Google Play Store. This is also required by local laws for any loan app or lending company operating in Nigeria.

In the list of blacklisted loan apps in Nigeria, NairaPlus is gaining the first entry. All Nigerian consumers to boycott the services of the NairaPlus loan app as it has consistently failed to comply with local laws and Google policies.

See the defaming message below NairaPlus sent to one of its customers a day a loan repayment was to fall due.

2. BorrowNow Loan App

In the list of fake loan apps in Nigeria, BorrowNow is gaining the second entry. All Nigerian loan seekers to boycott the services of the BorrowNow loan app for its excessively high interest, for failing to comply with Nigerian local laws and flouting Google policies on loan tenure.

BorrowNow loan app is one of those bad loan lenders that is fond of sending threatening and defamatory messages to their customers and borrowers. Nigerians should avoid it like a plague.

3. LCredit Loan App

The proliferation of fake loan apps in Nigeria is fast endangering and threatening the financial and digital space which has in greater terms facilitated financial inclusiveness of many citizens who have hitherto been inaccessible to the traditional banking system, and except regulatory authorities check their operations, more crisis may be ahead,

Last year, QUICK LOAN ARENA exclusively reported that LCredit, Rapid Transfer and some yet to be identified quick loan apps have been removed by Google from its Play Store for violating its operational policies.

The investigation reveals that LCredit was blacklisted by Google and banned from its Play Store because the fake loan app was discovered by Play Protect, the security system on Google Play Store that scans apps hosted on its network, as involved in malicious and fraudulent activities.

Google discovered that LCredit app was trying to spy on phone contacts, recordings, photos and other private content on the android devices of its users, contrary to Google laid down privacy policy.

Worst Loan Apps In Nigeria 2022

Play Protect by Google had warned users: “This app (LCredit App) tries to spy on your personal data such as SMS messages, photos, audio recording or call history.” It went further to warn users to immediately uninstall the blacklisted LCredit app from their phone, and that if they fail to do so, and open the app, they do so at their risk.

Some consumers who spoke with QUICK LOAN ARENA validated Google’s claim of LCredit and other loan apps spying illegally into their phones.

One of such is Folafaith on October 22, 2021, at 6:48 am told us: “Truly LCredit do spy on a person account, phone storage, contacts, messages and start calling your contacts and message them on WhatsApp and through normal messaging. If you fail to repay just for a day, they will start calling all your contacts and start calling the person a fraudster.”

She continues: “This scam activity is not only peculiar with LCredit, there are still many of the loan apps that does so, such as Sokoloan, Credit9ja, True Naira, Naira Plus, KasKash, Easycredit. Sokoloan for example will tell you to sell your property to repay them, even though you’re on a sick bed it doesn’t concern them.”

Another user, Tunji Adeleke on October 22, 2021, at 7:04 am told us: “Most of these obviously fake quick loan apps spy on your private information. They also spy on your SMS alert to know when you receive payment and other information. They will collect your phone contact list to which they begin to send threat messages to them and even call some of them.”

Another user of the app responded to QUICK LOAN ARENA in bewilderment. Vivian on October 21, 2021, at 2:21 pm says “I can’t find LCredit app on goggle again, what really happened? Bcoz I loaned from them.”

Obinna Michael on October 21 expressed his disappointment with the loan app. He adds to the query, “Money that has been paid with proof of transaction slips, LCredits loan app keep sending messages to contacts. If their systems are faulty they should fix it properly before coming into the business!”

Recall our earlier report yesterday that LCredit is a quick online loan app though hosted on Google Play Store with thousands of successful downloads but does not have an online presence in terms of the website nor a single physical office. This was of course a red flag on the now blacklisted lending app. credit is a fake loan app and Nigerians should avoid them by all means.

4. 9ja Cash Loan App.

9ja cash loan app is another fake loan app and it’s owned and managed by the deadly and blacklisted Sokoloan lending app.

9ja Cash which is owned and managed by Sokoloan Lending Company. Their manner is to threaten you with defamatory messages including the people in your contact list. This is unethical and unacceptable.

They charge high-interest rates, debit security fees from your account and illegally limit your loan tenure to 7 days instead of a minimum of 60 days.

5. Cash Wallet loan App

Scam app that deducts ‘down payment’ from your debit card

Cash Wallet is one of the fake loan apps in Nigeria. The lending platform claims to be a personal loan app in Nigeria where you can get quick loans using your mobile phone anywhere, anytime. The platform says it aims to make financing become easier for Nigerians. However, from our investigations, this claim is not true.

Loan Product:

– Loan Amount: ₦ 3,000 – ₦ 100,000 (FALSE. It doesn’t give loans, Cash Wallet deducts ‘down payment’ ranging from N3,000 to N10,000 once your debit card is registered with them.

– Loan Term: minimum 92 days – maximum 365 days/ (FALSE. It never gives a loan. If it does, won’t exceed 7 days.). All reviewers we featured confirmed Cash Wallet doesn’t give out loans but deduct illegally from their ATM card.

– Interest rate: from minimum 16% to maximum 35% APR( Annual Percentage Rate). FALSE. Cash Wallet has no loan to offer anyone.

– Other Fees: No other extra fees (FALSE. Cash Wallet fraudulently deducts service charges in form of a down payment from your registered debit card without giving you a loan.

Highlights

– 100% online process

– Affordable interest cost

– Flexible repayment schedule

– No hidden charges

All the above-highlighted claims about CASH WALLET are false, fraudulent and written to scam Nigerians.

This is the link to Cash Wallet on Google Play Store. Nigerian consumers and urgent loan seekers should boycott this app. This is our no 5 on our compilation list of fake loan apps in Nigeria. If you still have any doubt, read a few of the selected reviews of Cash Wallet on Google Play Store.

6. GGMoney Loan App

QUICK LOAN ARENA is at the forefront of the campaign against loan sharks and fake loan apps in Nigeria for their several unethical and untoward practices towards their customers and their contacts list which is beginning to gain momentum as the Federal Government is beginning to pay close attention to their activities.

Recall that QUICK LOAN ARENA earlier published a series of awareness and news reports about the activities of these fake loan apps and in some cases mentioned the names of some of them and even taking it further by alerting the Google Play store that hosts most of them which has resulted in Google removing some of the questionable apps from its Play Store.

Right now the advocacy is getting stronger and the Federal Government of Nigeria is already looking at sanctioning some of them that have violated the data privacy rights of the citizens.

7. 9Credit Loan App

In the list of fake loan apps in Nigeria, 9Credit is gaining the 7th entry. We advise all Nigerian loan seekers to boycott the services of the 9Credit loan app for unethical and untoward practices. For charging customers dubious high interest. Forgiving out loans for only 7 days instead of a minimum of 60 days as stipulated in the law. And for always defaming and threatening its customers and their contact list.

See the defaming message below 9Credit sent to the people in the contact list of one of its customers. These were people who never signed as guarantors nor were parties to the loan agreement. QUICK LOAN ARENA understands this is a descent so low and quite unethical.

How To Report A Loan Apps In Nigeria 2022

URGENTLY TREAT!!! This is to notify you that name; Temitope victor Obembe Phone: 081650-2655 / 08147-38922 is an INCONSIDERATE PERSON, THIS PERSON has PROVEN to be a CRUEL/HARD HEARTED DEBTOR, also we DISCOVERED that this PERSON IS A PERPETUAL/UNREMORSEFUL DEBTOR known ALL OVER THE FINTECH COMPANY IN NIGERIA, This DEBTOR goes around COLLECTING MONEY from different fund COMPANY without repaying.

This person has CURRENTLY REFUSE to REPAY the company’s money(NC)and has refused to pick up our calls. Please contact us if you have any information about this person as soon as possible, else the company will be FORCED to take LEGAL ACTION to RECOVER THIS fund, Kindly be INFORMED that this person provided us with all your details STATING that YOU both AGREE to COLLECT this fund from the US…

If you are not aware of this fund you can as well call the person to delete your information on the APP NOW, because SHORTLY the person DETAILS along sides yours will be PUBLISHED in a DRASTIC MANNER. NC

8. Sokoloan Loan App

Sokoloan is another fake lending platform in Nigeria. Below are the infractions of the scam loan app.

Give loans for 7 days as against the 91 to 360 days displayed in the Google Play store

Does not give loans up to #300,000 as it claims

Does not declare its real charges in the sense that, they display the amount of loan to be given and what they give actually is far lesser.

Like others, 7 days loan starts counting the moment you receive money in your account and what you see on your dashboard immediately is 6 days remaining. It’s never 7 days.

Failure to pay back as at when due will have their staff harass you, threaten you and send messages to people on your contact list that you should not be trusted and be told to pay back your debt.

9. Palmcash Loan App

See below what a leading lawyer has to say about Palmcash and other similar fake loan apps that are scamming Nigerians.

“The existence and operations of many of these soft and quick loan agencies are largely illegal. Their interest rates are similarly illegal majorly under the Moneylenders laws. The failure to pay the loan is a contractual one remediable by action for recovery and damages but they employ crude methods of blackmail and libel towards recovery. They are all actionable wrongs but usually, the owners of these quick loan companies are unknown or “miragy”. And the victims are mostly too embarrassed to seek remedy against them in court.” – Andy Akporugo Jr, Legal Practitioner.

Palmcash is fraudulent and contravenes Nigerian law.

The loan platform is faceless, has no physical address and no customer service personnel you can speak to. Please do yourself justice by boycotting their service.

10. Ease Cash Loan App

Ease Cash is another of the many fake loan apps in Nigeria. It is the new name for the banned and blacklisted rogue digital lending app, EasyMoni and is now fully hosted and registered on the largest internet network, Google! Borrowers Beware!

This is Ease Cash digital lending app on Google Play Store, the new loan app that replaces EasyMoni

EasyMoni the rogue digital lending app that was banned and blacklisted by Google weeks ago has changed its name to Ease Cash in order to escape and continue fleecing innocent Nigerian borrowers. The digital lending app is now fully reregistered as Ease Cash on Google Play Store.

EasyMoni got a terrible reputation for threatening and shaming its customers at any slight loan default or disagreement. The digital lending app is found terrorising and blackmailing Nigerian borrowers for a long while and has been in violation of customer data privacy. It has now found its way back to the giant tech network as Ease Cash.

QUICK LOAN ARENA warns borrowers and customers to beware of this notorious lending app so as to avoid sad tales of public disgrace which EasyMoni is known for.

EasyMoni digital lending app, now called Ease Cash is owned and managed by loan sharks from China and Hong Kong. It neither has an office nor telephone here in Nigeria but found of sending a threat to any customer who dares incur its wrath of defaulting its very high-interest loans and unfavourable conditions attached.

11. ForNaira Loan App

Listen to what a customer has to say about ForNaira, another of the many fake loan apps in Nigeria.

‘’ForNaira is the worst quick online loan app…just 1 day overdue and their agent sent a message to all my contacts that it was over 2 months and that I have refused to pick up calls or reply to messages. Meanwhile, the lady in question sent me a message at 5:45 am and I replied that I will pay by 4 pm, by 9 am, she started sending messages to my contacts…for what she has done I will not pay a dime again. You can’t defame me and still want me to pay you after all I was still going to pay for the overdue. I have evidence.

Urgent loan apps that are displaying their wares for Nigerians are presently uncountable and the result of this is the different fraudulent practices exhibited by the majority of these fake apps. Some are not even in the space to provide loans at all, all they do is steal from their customers. Another of such fake loan apps is Rapid Naira and Cash Club, etc.

Initially, for Naira quick loan app was hosted by Google Play Store but has been permanently banned and blacklisted after the giant network discovered it was fake and a scam.

What ForNaira app claims as its features:

– Borrow up to ₦300,000

– Fast and easy access to loans, with no hidden charges

– Account is credited as soon as the loan is approved

– No collateral or guarantor is needed

– our Loan App is extremely secure and reliable

– Artificial intelligence is used to run credit scoring, making loan decisions instant!

– We are available 24/7 to support you

Contrary, the ForNaira app does the following:

Give loans for 7 days as against the 91 to 360 days displayed in the Google Play store

Does not give loan up to #300,000

Does not declare its real charges in the sense that, they display the amount of loan to be given and what they give actually is far lesser.

Yes, they do not collect collateral but they ask for guarantors.

Like others, 7 days loan starts counting the moment you receive money in your account and what you see on your dashboard immediately is 6 days remaining. It’s never 7 days.

Failure to pay back as at when due will have their staff harass you, threaten you and send messages to people on your contact list that you should not be trusted and be told to pay back your debt.

12. GotCash

GotCash is one of the fake loan apps in Nigeria. QUICK LOAN ARENA discovered this early enough and warned Nigerians to avoid the scam loan app in an article published in November 2021 where it revealed how PalmCash and Gotocash and other rogue loan apps are defaming Nigerian consumers and why Google should blacklist them and take them down from its Play Store.

QUICK LOAN ARENA has been at the forefront of a campaign to get rid of rogue and fraudulent fake loan apps in Nigeria most of them also defaming and maligning their customers. Some of these apps are owned and managed in China or Hong Kong. Some managed in Nigeria are faceless, without any office or customer service telephone number. Those we have gotten evidence of their infringement and violating the data right of Nigerians we have blacklisted them and advised customers across the nation to boycott their service. Please avoid Gotcash, it’s a fake loan app.

13. NCash Loan App

NCash is another fake loan app that is still hosted in the Google Play Store at the time of publishing this article. The lending platform is not a legitimate platform but set up to scam Nigerians. It sends threats and horrible messages to you and your contacts whenever they believe you are owing them and insult you with every curse word possible.

Why Google still allows scam and fake loan apps like NCash, Sokoloan, PalmCash, 9credit, Cash Wallet and others to be hosted on their Play Store after multiple infractions on their operational and data policies is a mystery we are yet to unravel?

These loan apps are set up in our view to swindle unsuspecting Nigerians, asking them to make deposits before loan approval, deducting upfront service fees from their debit cards, and they charge interest rates as much as 100%, many times request repayment within 7 days. Nigerians should boycott all of them.

14. GoToCash Loan App

Google yanked off GotoCash and PalmCash, twin rogue and fake loan apps in Nigeria from its Play Store, on November 28th, 2021 over serial violations of its policy on customers’ data privacy.

Two other fake loan apps we have discussed earlier, BorrowNow and LendCash were removed around the same time for the same reason: violating customers’ data privacy and sending defamatory and threatening messages to its customers, their families and contact list. We advise Nigerians to avoid these fake loan apps like a plague. Even their interest is excessively high and they charge illegal service fees.

15. Fast Money Loan App

Fast Money is another fake loan app. Unfortunately, it is still hosted on Google Play Store. The Nigerian government has actually concluded plans to enforce regulatory laws and prosecute fake loan apps and lending platforms such as Fast Money, NowCash, Sokoloan, 9credit, LendCash, and others that are breaching the data privacy of their customers by sending threatening and blackmailing messages to them and their contact lists.

Nigerians and loan customers should avoid these apps by every and any means.

Fake Loan Apps In Nigeria and what The Federal Government is doing

The National Information Technology Development Agency (NITDA) in continuation of its efforts to address the alarming rates of data privacy abuse by money lending operators, has entered into a strategic partnership with the Federal Competition and Consumer Protection Commission (FCCPC). Section 17(a) of the FCCPA, 2019 empowers the Commission to administer and enforce provisions of every Nigerian law with respect to competition and protection of consumers.

NITDA has therefore found the FCCPC as a key stakeholder in its efforts to rein in the activities of some micro-money lenders who have formed a penchant for abuse of personal data of Nigerians.

These operators execute this by abusing their personal data, breaching their privacy and sharing it with others who are not part of the initial contract.

The Agency has received over 40 petitions from members of the public on the personal data abuse of some lending companies. Our investigation led to the imposition of a Ten million naira (N10,000,000) fine and other administrative sanctions on Soko Lending Company.

As an agency focused on using its mandate to empower Nigerians and make them active players in the digital economy, NITDA is very concerned about the worrisome effect the nefarious activities of the money lending companies is having on families, friends, and the society at large.

Some of the complainants had contemplated suicide, indicating that the government needed to do more to protect vulnerable Nigerians. The partnership with FCCPC will lead to a more robust and concerted regulatory approach which we believe would ensure that Nigerians get the necessary reprieve from the illegal use of their personal data for money lending operations.

Cull from; Quick Loan Arena

Related

[ad_2]

Source link

![#blackchully: Black Chully Video Breaks Internet [Watch Here], Black Chully News, Black Chully Real Name,Black Chully Songs, leaked tape vireo, black chullyy toto videos, black chully sex tape leak porn, black chully viral videos, nigerian tiktoker black chully viral video, black chully leaked video](https://voiceofgh.com/wp-content/uploads/2022/09/blackchully-nude-video-brandnewsday.png)